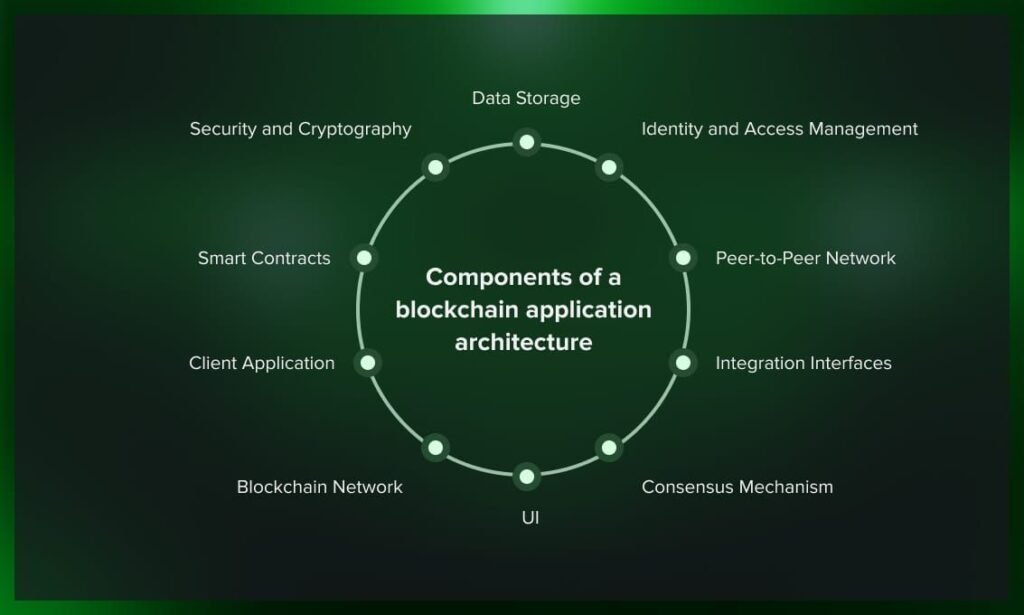

Traditional insurance claim systems are slow, opaque, and burdened by intermediaries. Decentralized peer-to-peer (P2P) insurance platforms offer an alternative—one where claims are processed based on transparent, rule-based logic executed on-chain.

This blog outlines how to architect such a platform using Cardano for the backend and Angular for the frontend. No fluff—just practical observations and a breakdown of architecture decisions.

Why Decentralized Insurance Claims?

Most people don’t distrust insurance itself—they distrust the lack of transparency in how claims are handled. By decentralizing the process:

- Every action becomes traceable and timestamped.

- Smart contracts enforce predefined rules.

- Payouts are issued automatically based on valid, verifiable inputs.

No manual approvals. No ambiguous delays.

Why Cardano in Decentralized ?

Cardano offers several advantages for P2P insurance:

- Deterministic smart contracts (Plutus) ensure claims logic executes predictably.

- Immutability and auditability: Once a claim is submitted, it’s permanently recorded.

- Low energy cost due to its Proof-of-Stake model.

- Native token support for managing insurance pools.

Cardano can handle:

- Claim submissions and metadata

- Rule-based payout processing

- Shared fund management

- Event history tracking

Why Angular Decentralized ?

For the frontend, Angular is a solid choice due to:

- Strong form handling (ideal for complex claim inputs)

- Integrated routing and state management

- Scalable architecture suited for multi-step workflows

User-side features include:

- File and submit new claims

- Upload supporting documents or media

- Track claim status in real-time

- View transaction history

- Manage their contribution to the insurance pool

How the Insurance Pool Works

The platform operates on a shared pool model:

- Users contribute tokens into a common fund.

- Claims are approved and paid out of this pool.

- Contributions determine claim limits and eligibility.

Design considerations:

- Contribution-weighted payouts: Higher contributions can unlock higher claim limits.

- Exit rules: Token withdrawal penalties may be needed to prevent misuse.

- Fraud detection: Peer voting, time locks, or automated evidence validation using oracles.

Ideal Use Cases

This model is not suited for large-scale health or life insurance, but it’s perfect for low-risk, verifiable claims such as:

- Travel insurance (e.g., delayed flights, lost luggage)

- Crop insurance (e.g., satellite or weather oracle-based damage verification)

- Device damage or theft claims

- Security deposits (e.g., property rental, condition inspection)

These cases benefit from minimal subjectivity and can be confirmed using digital proof or real-world oracles.

Technical Challenges and Considerations

- Oracle Dependency

Relying on third-party data sources (weather APIs, transport feeds) requires highly trusted oracles. Downtime or tampering affects claim integrity. - User Onboarding

Many users may not be comfortable with Web3 interfaces or wallets. A smooth UX with guided flows is crucial. - Gas and Scalability

While Cardano is more efficient than most, it still has throughput limitations. Redundant data and large volumes can cause bloat. - Legal Frameworks

Even as a decentralized platform, local insurance laws may apply. Ensure regulatory compliance or include jurisdiction disclaimers.

Conclusions

Decentralized insurance claims platforms are no longer just theoretical. With Cardano’s smart contract infrastructure and Angular’s frontend capability, it’s fully feasible to build a usable system today.

While it won’t replace large insurers overnight, this approach streamlines low-friction, claimable events—transparently, efficiently, and without centralized bottlenecks.

It’s a step toward reclaiming trust in insurance, and that’s worth building for.

Read more Posts:- How I Optimized My Company’s Cloud Costs with Kubernetes and Prometheus

Pingback: InfluxDB - Real-Time Coastal Wave Energy Monitoring| BGSs